Yale University, the Ivy League school that has invested in everything from Puerto Rican bonds to timber in New Hampshire, is getting into the market for cryptocurrencies.

Kudos to WallStreet analyst and advisor, Ric Edelman. He drank the Kool-Aid, he understands a profound sea change, and he sees the ducks starting to line up.

Check out the clearly articulated interview, below, with Bob Pisani at the New York Stock Exchange and legendary Wall Street advisor, Ric Edelman, (Not my term…That’s what CNBC anchor, Melissa Lee, calls him). Read between the lines, especially the last words in the video, below.

Ric Edleman has just joined Bitwise as both investor and advisor. This lends credibility and gravitas to the organization that created the world’s first cryptocurrency index fund. Bitwise benefits from Edelman’s affiliation, because the US has been slow (some would say “cautious”) in recognizing the facts on the ground: Cryptocurrency is already an asset class.

Edelman fully embraces a strong future for Bitcoin—not just as a currency or payment instrument, but as a legal and recognized asset class; one that is at the starting line of a wide open racetrack. He explains that the SEC sets a high bar for offering a Bitcoin ETF, but that this will be achieved. It will pave the way for large institutions, pension funds, etc to allocate a portion of money under management for blockchain products.

At timestamp 3:39, Melissa asks Edelman “Why wait for an ETF?” and “If you believe this strongly, why not advise clients to invest a portion of assets into Bitcoin right now?”

Edelman’s response is stunning. He explains that he is frustrated, because this is what he wants to advise. But, his firm is bound by the Investment Act of 1940—and so, they cannot tell a client “Go to Coinbase” or “Invest in a private fund such as Bitwise—that I am such a big fan of. We don’t have that ability in our practice.” [i.e. until the SEC recognizes Bitcoin as an asset].

In my opinion (and in the opinion of Edleman), SEC recognition of Bitcoin as an asset can’t be far off…

It’s not difficult to read between the lines. Edleman makes a clear recommendation, although he can not yet advise this—certainly not on the record. His personal forecast for long term adoption and appreciation, especially of Bitcoin, matches my own analysis. His new affiliation with Bitwise (a pretty bold move) demonstrates certain commitment.

This ends my analysis of Edelman’s strong endorsement. But it raises another important question:

If large financial institutions are likely to offer Bitcoin products

and services—and if credible analysts & advisors are chomping

at the bit to recommend this new asset class—shouldn’t we

invest in Bitcoin now?!

Ironically, I do not recommend hording or investing in cryptocurrency, even as a collectable. Why?! Because of the big “Investment Catch-22”. I don’t discourage investing in Bitcoin because I fear that its value will lessen. It is for a completely different reason. And so, my advice against investing is half-hearted.

Currently, Bitcoin and altcoins are widely misunderstood. Many people have these false impressions…

All of this is untrue, except the last item—and that one is a tremendous benefit.

Additionally, blockchain currencies fluctuate widely in real market purchasing power, many altcoins and all ICOs are scams, and acceptance is far from being ubiquitous. Clearly, widespread adoption requires stability, infrastructure, trust and ubiquity.

This cannot happen until two things occur:

Things are beginning to change, but for such a positive and transormative mechanism, that change is frustratingly gradual.

A series of falling dominos is already in process. But, the end game is retarded by those of us who invest in Bitcoin, because we are removing a limited resource from circulation and contributing to volatility. We do this, because we realize that—in the long run—Bitcoin can only go up in value. Yet, our investment at such an early stage (before consumer adoption) makes the infant sick.

Philip Raymond co-chairs CRYPSA, hosts the New York Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He advises The Disruption Experience in Singapore, sits on the New Money Systems board of Lifeboat Foundation and is a top Bitcoin writer at Quora. Book a presentation or consulting engagement.

But there’s a catch: what about the faithful ‘execution’ of a contract? Doesn’t that require trust as well? What good is an agreement, after all, if the text is there but people don’t respect it, and don’t follow through on their obligations? Which brings us back to the crucial matter of how Buterin managed to piss off so many people.

The great cryptocurrency heist.

Blockchain enthusiasts crave a world without bankers, lawyers or fat-cat executives. There’s just one problem: trust.

E J Spode

The Disruption Experience this Friday in Singapore is a blockchain event with a difference. With apologies to the Buick commercial, this is not your grandfather’s conference…

I know a few things about blockchain conferences. I produced and hosted the first Bitcoin Event in New York. My organization develops cryptocurrency standards and practices. We help banks and governments create policy and services. And as public speaker for a standards organization, I have delivered keynote presentations at conferences and Expos in Dubai, Gujarat India, Montreal and Tampa, New York and Boston.

Many individuals don’t yet realize that both Bitcoin and the blockchain are as significant as the automobile, the transistor and the Internet. I was fortunate to grasp Bitcoin and the blockchain early in its history. It is never boring to help others understand the blockchain.

And so, I am an evangelist for both a radically improved monetary system and a transformative tool. During the past eight years, I have honed the skill of converting even the most profound skeptic. Give me 45 minutes in front of any audience—technical, skeptical or even without any prior knowledge—and I will win them over. It’s what I do.

An Atypical Conference Venue

As Bitcoin and altcoins begin the process of education, adoption and normalization, the big expos and conference events have begun to splinter and specialize. Today, most blockchain events market their venue to specific market sectors or interests:

For me, Smart Contracts are one of the most exciting and potentially explosive opportunities. As a groupie and cheerleader, I am not alone. Catering to the Smart Contract community is rapidly becoming a big business. Until this week, I thought it was the conference venue that yielded the biggest thrills. That is, until I learned about the Disruption Experience…

For me, Smart Contracts are one of the most exciting and potentially explosive opportunities. As a groupie and cheerleader, I am not alone. Catering to the Smart Contract community is rapidly becoming a big business. Until this week, I thought it was the conference venue that yielded the biggest thrills. That is, until I learned about the Disruption Experience…

Few widely promoted, well-funded events address the 600 pound elephant in the room: What’s the real potential of blockchain trust, blockchain economy or blockchain AI? Take me beyond tokens and currency (please!). How can an international event help us to realize the potential of a radical new approach to accounting, trust and arbitration? Let’s stop arguing about Bitcoin, Ethereum or ICOs…

How can we unleash the gorilla—and grease—

a fundamental change that benefits mankind,

while providing leapfrog technologies for us?

—At least, that’s my spin on the potential of an unusually practical venue.

That question is slated to be answered on Friday at a big event in Singapore. And get this—It is modestly called a “Sneak Peak”. This is what I have been waiting for. The Disruption Experience premiers on September 28 at the V Hotel Lavender in Singapore. But don’t show up at the door. This event requires advance registration. (I do not offer a web link, because I hate being a conference huckster. If you plan to be in the area at the end of this week, then Google the event yourself).

What’s the big deal?

The Disruption Experience team is populated by blockchain developers, educators and trainers who take issue with existing events that focus on monetization. The purity of intention was overrun by greed. And so, they set out to form an event with a more altruistic purpose: Build technology, relationships, mechanisms and educational tools that better mankind. The focus at this event and the conferences that follow is to educate, expose and innovate. The focus is squarely on disruptive technology.

The Disruption Experience team is populated by blockchain developers, educators and trainers who take issue with existing events that focus on monetization. The purity of intention was overrun by greed. And so, they set out to form an event with a more altruistic purpose: Build technology, relationships, mechanisms and educational tools that better mankind. The focus at this event and the conferences that follow is to educate, expose and innovate. The focus is squarely on disruptive technology.

With their team of blockchain innovators focused on benefits and progress, I suspect that attendees will get what we have been searching for: Education, investment opportunities, an edge on new technologies and job opportunities.

Cusp of a Breakout Year

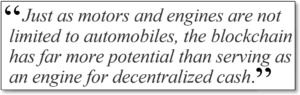

As an analogy, consider the race to understand Bitcoin and consider the engines & motors.

Bitcoin and the blockchain were introduced simultaneously in a 2009 whitepaper. It’s a bit like explaining the engine and the automobile together—for the very first time. One is a technology with a myriad of applications and the potential to that drives innovation. The other is an app. Sure, it’s useful and important, but it’s just an app.

Bitcoin and the blockchain were introduced simultaneously in a 2009 whitepaper. It’s a bit like explaining the engine and the automobile together—for the very first time. One is a technology with a myriad of applications and the potential to that drives innovation. The other is an app. Sure, it’s useful and important, but it’s just an app.

For 8 years, Bitcoin was a radical and contentious concept. Of course, there was the mystery of Satoshi and an effort to pinpoint his or her identity. And, a great debate raged about the legitimacy and value of decentralized, ethereal money. But, the interest was reflected primarily on the pages of Wired Magazine or at Geek-fests. Bitcoin was complex and costly to incorporate into everyday purchases and there were questions and gross misconceptions about hacking, regulation, taxes, criminal activity. The combined audience of adopters, academics, miners and geeks was limited.

That changed last year. With serious talk of exchange traded funds, a futures and derivatives market began to take shape. A critical operational bottleneck was addressed. Ultimately, 2017 was a breakout year for Bitcoin. You may not be using it today, but the smart money is betting that it will enhance your life tomorrow—at least behind the scenes.

Likewise, 2019 is likely to be the breakout year for blockchain applications, careers, products and—perhaps most importantly—public awareness, understanding and appreciation. Just as motors and engines are not limited to automobiles, the blockchain has far more potential than serving as an engine for decentralized cash. It is too important to be just a footnote to disruptive economics. It will disrupt everything. And we are the beneficiaries.

Likewise, 2019 is likely to be the breakout year for blockchain applications, careers, products and—perhaps most importantly—public awareness, understanding and appreciation. Just as motors and engines are not limited to automobiles, the blockchain has far more potential than serving as an engine for decentralized cash. It is too important to be just a footnote to disruptive economics. It will disrupt everything. And we are the beneficiaries.

What is Interesting at The Disruption Experience?

The Friday event in Singapore covers many things. The presentations and tutorials that quicken my pulse relate to:

If you read my columns or follow my blog, then you know I am not keen on initial coin offerings (ICOs). That’s putting it mildly. They are almost all scams. But a rare exception is the Tempow ecosystem which encompasses three functional tokens. Stop by their exhibit and meet the officers of a sound economic mechanism that facilitates decentralized trading while overcoming the efficiency paradox.

What can I do at Disruption Experience?

The September 28 event is a preview for January’s Inaugural Event.

Meet the Disruption Team

Meet the Disruption Team… and much, much more.

If you get to the big event, be sure to find the organizer and host, Coach Mark Davis. Tell him that I sent you. His passion and boundless enthusiasm for the blockchain and especially for transformative disruption is quite infectious.

Related reading:

Philip Raymond co-chairs CRYPSA, hosts the New York Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He sits on the New Money Systems board of Lifeboat Foundation and is a top Bitcoin writer at Quora. Book a presentation or consulting engagement.

“It’s the first time that humans have ever had the ability to send money around the world globally without anyone being able to stop it,” he said. “You can argue that it’s the first time in our history that we have real censorship resistance.”

Gladstein feels we’re at a crossroads as a society—we’ll either go down a centralized path where our interactions are surveilled and censored, or we’ll go down a decentralized one that preserves our essential freedoms and rights.

Technology’s role is somewhat paradoxical in this crossroads; some forms can serve as a tool of control for governments or companies, while other forms put more power in the hands of citizens.

The virtual currency markets have been through booms and busts before — and recovered to boom again. But this bust could have a more lasting impact on the technology’s adoption because of the sheer number of ordinary people who invested in digital tokens over the last year, and who are likely to associate cryptocurrencies with financial ruin for a very long time.

The number of people who bought virtual currencies more than doubled last winter. For people who got in late, the bust has been disastrous.