Five of the world’s biggest central banks recently announced that they’ve banded together to seriously explore central bank digital currencies.

The crypto market has been able to add on over $20 billion to its total capitalization, with the upswing seen today by Bitcoin and many of its smaller counterparts marking a full erasure of the losses incurred during the mid-March meltdown.

The significance of today’s price action extends far beyond just boosting the market’s technical strength, as it has also revitalized investors – an occurrence indicated by trading volume on crypto exchange Binance hitting a fresh all-time high today.

This comes as the benchmark cryptocurrency’s fundamental undercurrent grows stronger, with the influx of new retail investors into BTC suggesting that there may be a shifting market dynamic that ultimately allows it to continue climbing higher.

New numbers from the digital asset management giant Grayscale show investors are collectively throwing big money into Ethereum for the first time, on top of record investment numbers for Bitcoin.

According to Grayscale’s Q1 2020 report, institutions are taking a serious interest in ETH, enough to print a record quarterly inflow into the Grayscale Ethereum Trust.

Spencer Noon, the head of crypto investments at DTC Capital, says the numbers show Ethereum has reached a turning point with high-net worth investors.

Cool read…hhh.

The emergence of Bitcoin as one of the hottest new investment assets has surprised many who once believed the blockchain-driven cryptocurrency would never have real-world value. It has also generated immense amounts of interest from those who had either never heard of Bitcoin before or who knew relatively little about it. As a result, there are now incredible opportunities for making extra money in the cryptocurrency niche.

In the following article, you’ll find out how to make money with Bitcoin and discover a few of the many different ways to capitalize on the cryptocurrency trend and earn Bitcoin in lots of different ways.

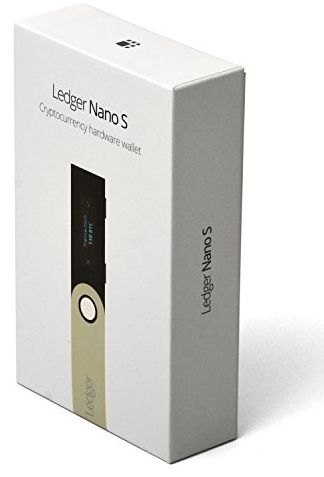

Remember, keeping your bitcoins or altcoins on your exchange wallets is highly insecure. You should never store then on the exchange for longer than is necessary. To make your Bitcoins, LiteCoins or any other crypto currency safe, you will need a hardware wallet like the Ledger Nano S or Trezor.

Despite the crashing markets, companies are working hard to boost the further adoption of Bitcoin and cryptocurrencies. In two separate announcements, Coinbase and the popular internet browser Opera revealed that they’ve made serious strides in this regard.

Coinbase Card Usable With Google Pay

The leading cryptocurrency exchange in the US, Coinbase, allows its users to get a cryptocurrency card through a partnership with Visa. Now, the card has enabled users to spend Bitcoin and other cryptocurrencies directly from their Coinbase account using Google Pay.

Many of you know the sad news that theoretical physicist & mathematician Freeman Dyson has passed away, so in celebration of his life and achievements, Anders Sandberg (Future of Humanity Institute) discusses Freeman Dyson’s influence on himself and others — How might advanced alien civilizations develop (and indeed perhaps our own)?

We discuss strategies for harvesting energy — star engulfing Dyson Spheres or Swarms, black hole swallowing tungsten dyson super-swarms and other galactic megastructures, we also discuss Kardashev scale civilizations (Kardashev was another great mind who we lost recently), reversible computing, birthing ideal universes to live in, Meinong’s jungle, ‘eschatological engineering’, the aestivation hypothesis, and how all this may inform strategies for thinking about the Fermi Paradox and what this might suggest about the likelihood of our civilization avoiding oblivion. though Anders is more optimistic than some about our chances of survival…

Anders Sandberg (Future of Humanity Institute in Oxford) is a seminal transhumanist thinker from way back who has contributed a vast amount of mind blowing material to futurology & philosophy in general. https://en.wikipedia.org/wiki/Anders_Sandberg

Happy Future Day (march 1st) : http://future-day.org

Freeman Dyson: https://en.wikipedia.org/wiki/Freeman_Dyson

Dyson Sphere: https://en.wikipedia.org/wiki/Dyson_sphere

Aestivation Hypothesis: https://en.wikipedia.org/wiki/Aestivation_hypothesis

Reversible Computing: https://en.wikipedia.org/wiki/Reversible_computing

Kardashev Scales: https://en.wikipedia.org/wiki/Kardashev_scale

Nikolai Kardashev: https://en.wikipedia.org/wiki/Nikolai_Kardashev

Many thanks for watching!

Consider supporting SciFuture by:

Cue in MolochDAO. Launched as a decentralized autonomous organization (DAO) by SpankChain co-founder and chief executive officer Ameen Soleimani earlier this year, MolochDAO puts members’ ether (ETH) tributes toward funding Ethereum projects that members vote on.

The can-do, do-it-yourself attitude of the group has proven popular in the Ethereum community and has already influenced several spinoffs, leading some to credit Moloch with a resurgence in Ethereum DAOs.

On August 16th, the DAO’s associated Twitter account reflected on what the group has accomplished in its first six months in operation.

O.o!

Portfolio manager and crypto analyst Mati Greenspan says billions of dollars are essentially sitting on the sidelines, ready to move into Bitcoin, Ethereum, XRP and the altcoin market at large.

Greenspan is using data from the crypto research firm Messari, which shows that the total value of all stablecoins is just shy of $6 billion. Stablecoins are digital currencies that are pegged to traditional assets like fiat. They’re designed to maintain a steady value and offer crypto traders an easy way to sidestep the extreme volatility of the crypto markets.

Greenspan’s theory implies that the billions of dollars in the stablecoin market represent traders who have decided to exit their positions in BTC, ETH, XRP and other crypto assets and are waiting for the optimal time to re-enter the market.