Not many pure-play quantum computing start-ups have dared to go public. So far, the financial markets have tended to treat the newcomers unsparingly. One exception is IonQ, who along with D-Wave and Rigetti, reported quarterly earnings last week. Buoyed by hitting key technical and financial goals, IonQ’s stock is up ~400% (year-to-date) and CEO Peter Chapman is taking an aggressive stance in the frothy quantum computing landscape where error correction – not qubit count – has increasingly taken center stage as the key challenge.

This is all occurring at a time when a wide variety of different qubit types are vying for dominance. IBM, Google, and Rigetti are betting on superconducting-based qubits. IonQ and Quantinuuum use trapped ions. Atom Computing and QuEra use neutral atoms. PsiQuantum and Xanadu rely on photonics-based qubits. Microsoft is exploring topological qubits based on the rare Marjorana particle. And more are in the works.

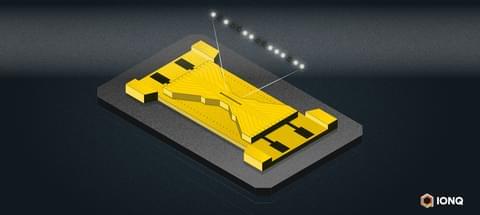

It’s not that the race to scale up qubit-count has ended. IBM has a 433-plus qubit device (Osprey) now and is scheduled to introduce 1100-qubit device (Condor) late this year. Several other quantum computer companies have devices in the 50–100 qubit range. IonQ’s latest QPU, Forte, has 32 qubits. The challenge they all face is that current error rates remain so high that it’s impractical to reliably run most applications on the current crop of QPUs.