|

|

|

|

|

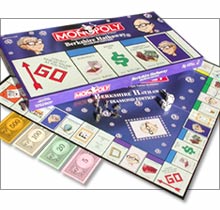

| Source: Berkshire Hathaway 2004 annual report |

|

|

| Buffett's Monopoly

|

Investment guru's holdings highlighted in Berkshire Hathaway version of popular board game. (full story)

Investment guru's holdings highlighted in Berkshire Hathaway version of popular board game. (full story)

|

|

|

|

|

|

OMAHA, Neb. (CNN/Money) - It was below freezing in Omaha early Saturday

morning, with frost silvering the golf courses and rolling lawns of the

city where Warren Buffett's Berkshire Hathaway Inc. is headquartered.

But the atmosphere was warm inside the Qwest Center arena, where

roughly 20,000 shareholders gathered from around the world to hear

Buffett and his vice chairman, Charles Munger, answer questions for

more than five-and-a-half hours.

Not a single individual shareholder asked about whether Berkshire

might be implicated in the widening scandal about alleged earnings

manipulations at American International Group – and even the money

managers in the audience whose questions touched on the subject

approached it gingerly. (Buffett announced at the outset that, at the

request of the investigators who are exploring the AIG case, he could

not discuss what he or other Berkshire executives might have revealed

about AIG to the authorities.)

Buffett's shareholders are true believers; to them, the idea that he could have done (or known about) anything wrong is absurd.

In his answers to shareholders' questions, Buffett made it clear

that he remains concerned about the trade deficit and the US dollar,

although he is bullish on the long-term strength of the U.S. economy.

But he and Munger issued stern new warnings about the residential real

estate "bubble," the destabilizing effect of hedge funds on the

financial markets, and the possibility of another terrorist strike

against the United States.

They also warned that they do not see a clear future for

pharmaceutical stocks, that GM and Ford face severe trouble over

pension and health costs, that hedge funds could wreak havoc in a

market decline, and that the New York Stock Exchange is doing a

disservice to investors by going public.

As always, Buffett spoke in elaborate paragraphs when replying to

shareholders' questions, while Munger spoke in terse, tart sentences.

The two often disagree about political and social policy, but for much

of this meeting they sounded like identical twins. What follows is an

edited and approximate transcript of their remarks.

Buffett and Munger on:

On real estate

Buffett: "A lot of the psychological well-being of the American

public comes from how well they've done with their housew over the

years. If indeed there's been a bubble, and it's pricked at some point,

the net effect on Berkshire might well be positive [because the

company's financial strength would allow it to buy real-estate-related

businesses at bargain prices]....

"Certainly at the high end of the real estate market in some areas,

you've seen extraordinary movement.... People go crazy in economics

periodically, in all kinds of ways. Residential housing has different

behavioral characteristics, simply because people live there. But when

you get prices increasing faster than than the underlying costs,

sometimes there can be pretty serious consequences."

Munger: "You have a real asset-price bubble in places like parts of California and the suburbs of Washington, DC. "

Buffett: "I recently sold a house in Laguna for $3.5 million. It

was on about 2000 sq. ft of land, maybe a twentieth of an acre, and the

house might cost about $500,000 if you wanted to replace it. So the

land sold for something like $60 million an acre."

Munger: "I know someone who lives next door to what you would

actually call a fairly modest house that just sold for $17 million.

There are some very extreme housing price bubbles going on."

The trade deficit and the value of the dollar

Buffett: "That really is the $64,000 question. It seems to me

that a $618 billion trade deficit, rich as we are, strong as this

country is, well, something will have to happen that will change that.

Most economists will still say some kind of soft landing is possible. I

don't know what a soft landing is exactly, in how the numbers come down

softly from levels like these....

"There are more people [like hedge-fund managers] that go to bed at

night with a hair trigger than ever before, it's an electronic herd,

they can give vent to decisions that move billions and billions of

dollars with the click of a key. We will have some exogenous event, we

will have that. There will be some kind of stampede by that herd....

"When you have far greater sums than ever before, in one asset class

after another, that are held by people who operate on a hair-trigger

mechanism, then they lend themselves to more explosive outcomes. People

with very short time horizons with huge sums of money, they can all try

to head for the exits at the same time. The only way you can leave your

seat in burning financial markets is to find someone else to take your

seat, and that is not always easy...."

Munger: "The present era has no comparable referent in the past

history of capitalism. We have a higher percentage of the

intelligentsia engaged in buying and selling pieces of paper and

promoting trading activity than in any past era. A lot of what I see

now reminds me of Sodom and Gomorrah. You get activity feeding on

itself, envy and imitation. It has happened in the past that there came

bad consequences."

Buffett: "I have no idea on timing. It's far easier to tell what

will happen than when it will happen. I would say that what is going on

in terms of trade policy is going to have very important consequences.

"

Munger: "A great civilization will bear a lot of abuse, but

there are dangers in the current situation that threaten anyone who

swings for the fences."

Buffett to Munger: "What do you think the end will be?"

Munger: "Bad."

Buffett: "We're like an incredibly rich family that owns so much

land they can't travel to the ends of their domain. And they sit on the

front porch and consume a little bit of everything that comes in, all

the riches of the land, and they consume roughly 6 percent more than

they produce. And they pay for it by selling off land at the edge of

the landholdings that can't see. They trade away a little piece every

day or take out a mortgage on a piece.

"That scenario couldn't end well. And we, also, keep consuming more

than we produce. It can go on a long time. The world has demonstrated a

diminishing enthusiasm for dollars in the last few years as they get

flooded with them – every day there's $2 billion more going out than

in. I have a hard time thinking of any outcome from this that involves

an appreciating dollar.

[But, Buffett later added, he is not predicting an end to US

economic power:] "If you have a good business in this country that's

earning dollars, you'll still do OK. Twenty years from now, a couple

percentage points of GDP may go to servicing the deficit, but you'll do

fine.... I don't think trade deficits will pull down the whole place;

the country will survive those dislocations. I'm not pessimistic about

the US at all.... We have over 80 percent of our money tied to the

dollar. It's not like we've left the country."

The threat of terrorism

Buffett: My job is to think absolutely in terms of the worst

case and to know enough about what's going on in both [Berkshire's]

investments and operations that I don't lose sleep. Everything that can

happen will happen....It's Berkshire job to be prepared absolutely for

the very worst. A few years ago we did not have NBCs [nuclear,

biological, and chemical attacks] excluded from our exposure, but we do

now....

"If you go to lastbestchance.org, you can obtain a tape, free, that

the Nuclear Threat Initiative has sponsored, that has a dramatization

that is fictional but is not fanciful. We would regard as ourselves as

vulnerable to extinction as a company if we did not have nuclear,

biological and chemical risks excluded from our policies. There could

be events happening that could make it impossible for our checks to

clear the next day."

The overall climate for investors

Buffett: "If the [stock] market gets cheaper we will have many

more opportunities to do something intelligent with money. We are going

to be buying things [like stocks and other financial assets] for as

long as I live, just as I'm going to be buying groceries for the rest

of my life. Would I rather have grocery prices go up or down?

"The stock market works the same way: If I'm a net buyer obviously I

would rather have prices go down than up. Charlie and I spend no time

talking about what the stock market is going to do, because we don't

know. We're not operating on basis of a market forecast. We don't make

a list of the good things that are happening or bad things.

"Overall, I'm an enormous bull on the country. This is the most

remarkable success story in the history of the world. It does not make

sense to bet against America. I do not get pessimistic about the

country. The real worry is what can be done by terrorists or

governments that may have access to nuclear or other weapons....

"If you had to make a choice between long-term bonds at around 4.5

percent and equities for the next 20 years, I would certainly prefer

equities. But if people think they can earn more than 6-7 percent a

year, they're making a big mistake. I don't think we're in bubble-type

valuations in equities -- or anywhere close to bargain valuations.

"If you told me I had to go away for 20 years, I would rather take

an index fund over long-term bonds. You'll get a chance to do something

extremely intelligent with your money in the next few years. But right

now there doesn't seem to be a clear enough direction to conclude

anything dramatic."

The auto industry

Buffett: "[GM boss] Rick Waggoner and [Ford chairman] Bill Ford

have both been handed, by past managers, extremely difficult hands to

play. They're not the consequences of their own doing, but they have

inherited a legacy cost structure, with contracts put in place decades

ago, that make it very difficult for them to be competitive in today's

world.

"Just imagine if they'd been made to sign contracts that made them

pay several more tons per steel than their competitors have to, people

would feel that's untenable. [GM and Ford] have to pay contracts that

give them immense obligations for health-care and retirement annuities

at high cost. Their competitiors can buy steel and other commodities no

cheaper, but the competitors don't have nearly the same level of costs

for these [health-care and retirement expenses].

"Someone once asked Bill Buckley what he would do if he actually won

his race for New York mayor back and the 1960s and he said, 'First

thing I'd do is ask for a recount.' Well, that's what I'd do at GM.

You've got a $90 billion pension fund, $20 billion set aside for

health-care liabilities, and the whole equity value of the company is

$14 billion. That's not sustainable.... Something will have to give."

Munger: "Warren gave a very optimistic prognosis. Some people

seem to think there's no trouble just because it hasn't happened yet.

If you jump out the window at the 42nd floor and you're still doing

fine as you pass the 27th floor, that doesn't mean you don't have a

serious problem. I would want to address the problem right now. They'd

better face it."

The NYSE's merger with Archipelago

Buffett: "I personally think it would be better if the NYSE

remained as a neutral, not-for-big-profit institution. The exchange has

done a very good job over the centuries. It's one of the most important

institutions in the world. The enemy of investment is activity.... I

know the American investor will not be better off if volume doubles on

the NYSE, and I know the NYSE will be trying to figure out how to do

that if it is trying to maximize its own earnings per share. GM or IBM

will not earn more money if their stock turns over more actively, but a

for-profit NYSE will."

Munger: "I think we have lost our way when people like the

[board of] governors and the CEO of the NYSE fail to realize they have

a duty to the rest of us to act as exemplars. You do not want your

first-grade school teacher to be fornicating on the floor or drinking

alcohol in the closet and similarly you do not want your stock exchange

to be setting the wrong moral example."

Whether pharmaceutical stocks have become bargains

Buffett: "That industry is in a state of flux right now. It's

historically earned very good returns on invested capital, but it could

be well be that the world will unfold differently in the future than in

the past. I'm not sure I can give you a good answer on that."

Munger: "We just throw some decisions into the "too hard" file and go onto others."

|